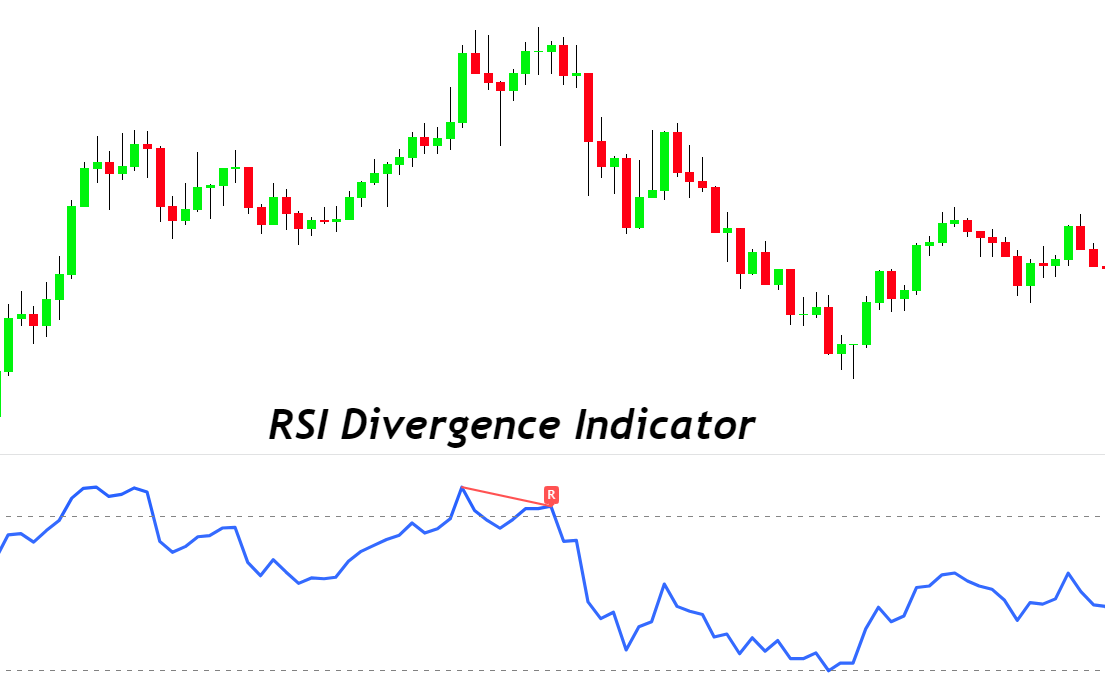

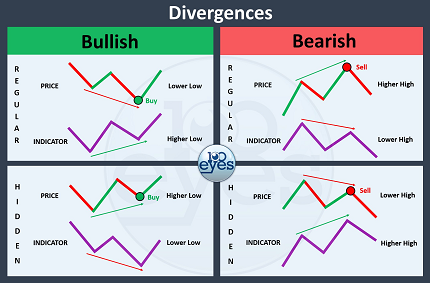

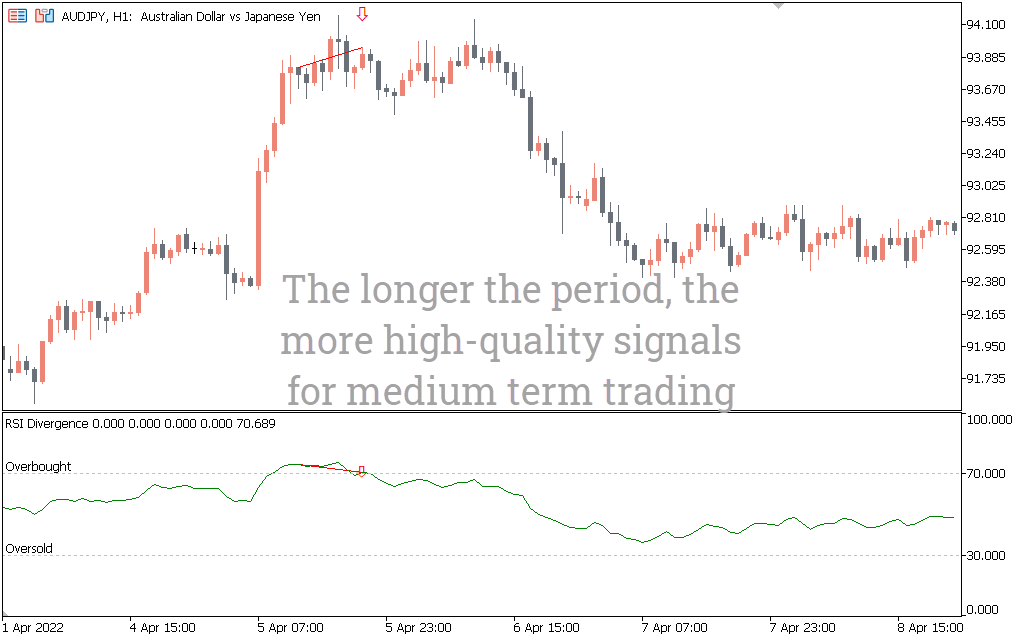

What Is The Difference Of Regular Divergence And Hidden Divergence?

Regular Divergence occurs the case when an asset's price is an upper or lower low, while its RSI makes a lower or higher low. It can indicate a potential trend reversal. However, it is crucial to take into consideration other technical and fundamental factors to ensure confirmation.Hidden Divergence: A hidden divergence is when an asset's price is lower high or a higher low and the RSI is able to make a higher high or lower low. Although this signal may not be as strong as regular divergence it can still indicate potential trend reversal.

Consider technical aspects

Trend lines and levels of support/resistance

Volume levels

Moving averages

Other oscillators , technical indicators and other indicators

It is important to consider these fundamental aspects:

Releases of data on economic issues

Details specific to your company

Market sentiment and indicators of sentiment

Global events and their effects on the market

Before making investment decisions solely based on RSI divergence signals it's important to look at both the technical and fundamental factors. Check out the most popular position sizing calculator for site tips including trading platform cryptocurrency, crypto backtesting, best trading platform, crypto trading backtester, automated trading software, divergence trading forex, best crypto trading platform, position sizing calculator, crypto trading backtesting, forex backtesting software free and more.

What Is The Difference Of Regular Divergence And Hidden Divergence?

Regular Divergence occurs the case when an asset's price is an upper or lower low, while its RSI makes a lower or higher low. It can indicate a potential trend reversal. However, it is crucial to take into consideration other technical and fundamental factors to ensure confirmation.Hidden Divergence: A hidden divergence is when an asset's price is lower high or a higher low and the RSI is able to make a higher high or lower low. Although this signal may not be as strong as regular divergence it can still indicate potential trend reversal.

Consider technical aspects

Trend lines and levels of support/resistance

Volume levels

Moving averages

Other oscillators , technical indicators and other indicators

It is important to consider these fundamental aspects:

Releases of data on economic issues

Details specific to your company

Market sentiment and indicators of sentiment

Global events and their effects on the market

Before making investment decisions solely based on RSI divergence signals it's important to look at both the technical and fundamental factors. Check out the most popular position sizing calculator for site tips including trading platform cryptocurrency, crypto backtesting, best trading platform, crypto trading backtester, automated trading software, divergence trading forex, best crypto trading platform, position sizing calculator, crypto trading backtesting, forex backtesting software free and more.

What Are Strategies For Backtesting When Trading Crypto

Backtesting strategies for crypto trading involves replicating the operation of a trading strategy using historical data in order to evaluate its efficiency. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy Definition of the trading strategy to be tested with regard to entry and exit rules size of positions, risk management guidelines.

Simulator: Use software to create a simulation of trading strategies based on historical data. This lets you visualize how the strategy might perform in the past.

Metrics: Examine the performance of the strategy using metrics like profitability, Sharpe ratio, drawdown as well as other pertinent measures.

Optimization: Adjust the strategy parameters and run the simulation once more to optimize the strategy's performance.

Validation: Test the strategy's performance using data that is out-of-sample in order to test the strategy's reliability.

It is essential to keep in mind that past performance isn't an indicator of future performance Backtesting results should not be relied upon as a guarantee of future returns. It is also essential to consider the impact of the volatility of markets as well as transaction costs and other real-world considerations when applying the strategy in live trading. Have a look at the recommended automated crypto trading for more examples including crypto trading backtester, crypto trading bot, crypto backtesting, best crypto trading platform, automated cryptocurrency trading, best forex trading platform, automated trading, divergence trading forex, best forex trading platform, forex backtesting and more.

What Are Strategies For Backtesting When Trading Crypto

Backtesting strategies for crypto trading involves replicating the operation of a trading strategy using historical data in order to evaluate its efficiency. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy Definition of the trading strategy to be tested with regard to entry and exit rules size of positions, risk management guidelines.

Simulator: Use software to create a simulation of trading strategies based on historical data. This lets you visualize how the strategy might perform in the past.

Metrics: Examine the performance of the strategy using metrics like profitability, Sharpe ratio, drawdown as well as other pertinent measures.

Optimization: Adjust the strategy parameters and run the simulation once more to optimize the strategy's performance.

Validation: Test the strategy's performance using data that is out-of-sample in order to test the strategy's reliability.

It is essential to keep in mind that past performance isn't an indicator of future performance Backtesting results should not be relied upon as a guarantee of future returns. It is also essential to consider the impact of the volatility of markets as well as transaction costs and other real-world considerations when applying the strategy in live trading. Have a look at the recommended automated crypto trading for more examples including crypto trading backtester, crypto trading bot, crypto backtesting, best crypto trading platform, automated cryptocurrency trading, best forex trading platform, automated trading, divergence trading forex, best forex trading platform, forex backtesting and more.

How Can You Review The Software For Backtesting Forex While Trading With Divergence

These are the primary aspects to consider when looking at forex backtesting software that allows trading with RSI Divergence.

Flexibility Ingenuity: Different RSI divergence trading strategies are able to be customized and tested with the software.

Metrics: The software must offer a variety of indicators to evaluate the performance of RSI diversity trading strategies. These include profitability, risk/reward ratios and drawdown.

Speed: The program should be efficient and fast that allows for rapid testing of different strategies.

User-Friendliness. Even for those who do not have a lot of technical analysis knowledge, the software must be simple to use.

Cost: Consider the cost of the software, and whether it's within your budget.

Support: The software should offer excellent customer support including tutorials, technical support and many other support services.

Integration: The program must integrate with other trading tools such as charting software and trading platforms.

Before purchasing subscriptions, it's crucial to check out the software before purchasing it. Take a look at best online trading platform for website examples including backtester, best trading platform, position sizing calculator, automated trading platform, automated trading, backtester, position sizing calculator, backtesting, automated trading bot, best trading platform and more.

How Can You Review The Software For Backtesting Forex While Trading With Divergence

These are the primary aspects to consider when looking at forex backtesting software that allows trading with RSI Divergence.

Flexibility Ingenuity: Different RSI divergence trading strategies are able to be customized and tested with the software.

Metrics: The software must offer a variety of indicators to evaluate the performance of RSI diversity trading strategies. These include profitability, risk/reward ratios and drawdown.

Speed: The program should be efficient and fast that allows for rapid testing of different strategies.

User-Friendliness. Even for those who do not have a lot of technical analysis knowledge, the software must be simple to use.

Cost: Consider the cost of the software, and whether it's within your budget.

Support: The software should offer excellent customer support including tutorials, technical support and many other support services.

Integration: The program must integrate with other trading tools such as charting software and trading platforms.

Before purchasing subscriptions, it's crucial to check out the software before purchasing it. Take a look at best online trading platform for website examples including backtester, best trading platform, position sizing calculator, automated trading platform, automated trading, backtester, position sizing calculator, backtesting, automated trading bot, best trading platform and more.

Hp Printers make the best printer to be used in any device with speed and high quality printing. But even some printers will not work properly. Here we discuss the Printer in error state Windows 10. The time will come when all Hp printer users will need support with this product. Customers always prefer a good printer for their office. They prefer only branded quality products. hp was a nice product in the market.